FY26 Tax Payment Information

Office Hours for Tax Payments

Monday, Tuesday, Thursday - 8:30AM - 3:30PM

Wednesdays - 9:30AM - 12:00PM or by appointment

Special Hours on September 17th and February 11th - 8:00AM - 6:00PM

Taxes are due on or before 6:00 PM on Due Dates Sept. 17, 2025, and Feb. 11, 2026.

By Mail

Mail your check or money order and payment stub to Town of Sharon, PO Box 250, Sharon, VT 05065. If you include a self-addressed stamped envelope, we will return your payment stub. Payments must have a USPS postmark on or before the tax due date to prove they are on time.

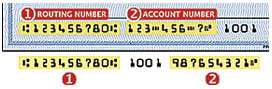

You can submit a form to us two weeks BEFORE the tax due date to have your payment taken from your designated bank account on future tax due dates. This form with detailed information can be found on the back side of this page or online at sharonvt.net.

The Town of Sharon offers several options for making tax payments, and we hope one will work well for you.

Property taxes are paid in two installments in the Town of Sharon.

For the fiscal year beginning July 1st, 2025 and ending June 30th, 2026, the first payment of real and property taxes is due by 6:00 PM on or before Wednesday, September 17, 2025.

The second payment is due by 6:00PM on or before Wednesday, February 11, 2026.

A Few Special Notes:

-

- All Payments Should Include Your Parcel ID# (not the SPAN #).

- Please check your bill to make sure you have the correct status of homestead vs. non-homestead and if you received your expected State Payment credit per the letter you received from the VT Dept of Taxes.

- FY2026: Tax payments not made by 2/11/26 at 6pm will be subject to an 8% penalty – the Town voted to go back to the 8% penalty this year rather than the graduated penalty allowed last year. Taxes paid late for the Sept. 17, 2025 and/or the Feb. 11, 2026 due dates will be charged 1% interest per month until paid in full.

For tax payment information, please call Lucy Pierpont, Finance Manager, at 802-763-8268 ext. 8 or Deb Jones, Treasurer, at ext.3.

Alternatively, you may email Lucy at financemgr@sharonvt.net or Deb at treasurer@sharonvt.net.

Please be aware that you will only receive one bill in mid-August with payment stubs for both the September and February payments and that your tax bill is mailed to your address, not to your mortgage lender’s address. If you have purchased after April 1, 2025, your bill will be sent to the prior owner. Please contact the Town for a copy of the bill.

Drop Box

Use the Drop Box: You may use the side door Drop Box to drop a check or money order (no cash!) in a small envelope with parcel information at the Town Offices at 15 School St by 6:00 PM on the Tax Due Dates or any day prior to the due date. If you include a self-addressed stamped envelope, we will return the stub from your bill as a receipt. Do not use the Ballot Drop Box.

Auto Pay ACH

Online Payment Options

Credit Card

Credit Card Online Payment Option: You can pay from the comfort of your home or office by using our online payment service with Municipay by clicking on the “Pay Your Bill Online” box. Credit cards accepted: MasterCard, Discover, American Express or Visa. For this service, the payment processing company will charge you a minimum $3.00 fee for charges up to $113.00 and a 2.65% fee for charges over $113.00 to your credit card. You will need your Parcel ID# (not the SPAN#) to identify the tax bill you wish to pay.

Electronic Check

By Appointment

You may stop in at the Town Offices and make a payment in person M, T & TH between the hours of 8:30am and 3:30pm and between 9:30am and 12:00pm on Wednesdays or by making an appointment.

We offer special hours on tax due dates of 9/17/25 & 2/11/26 8am-6pm. Please ask Lucy and Deb for tax payment information.

If Lucy or Deb are not available, Cathy Sartor, Town Clerk, will accept payments but will not be able to give payment status or balance information.

FY26 Taxes Due in 2025-2026

Wednesday, September 17, 2025

Wednesday, February 11, 2026